Living Benefits with Life Insurance – Facts that you Need to Know

Why do people buy life insurance?

Once income crosses expenses, it is time to start putting an excellent financial plan together. Financial planning involves taking sound decisions on where you want to invest your income. These investments eventually should help you meet your life goals and give you a sense of security and confidence in life.

A good plan covers all important events in life like a wedding, buying a house, and paying for your children’s college fees. Apart from helping you achieve your dreams, a financial plan should also cover the potential situation of your death. Death can turn all these dreams into a major financial crisis for your surviving family.

A mortgage is among the most significant costs an American family incurs. Children’s education is expensive. You need to save your family from a situation where they will have to deal with all this on their own. Your financial plan should include life insurance to achieve this.

Once you include life insurance in your financial plan, you can be assured of, what is known as, death benefits. A death benefit is a part of the life insurance contract where benefits in the form of guaranteed payments to the beneficiary after the death of the insurance holder. Their payments can be lump-sum amounts or can be periodical.

However, what happens when you have an unexpected critical illness and need financial help? Can life insurance help you in this case? The answer is, yes, it can. If you take an add-on benefit called living benefits, your life insurance covers critical illnesses during your life that you did not expect to affect you.

What is a Living Benefit Option?

Living benefitsis a rider that allows the policyholder to get a certain amount as an early payout of death benefits while they are alive. It helps during the most critical of situations where the life expectancy of the policyholder is less than one year.

In case of an unexpected terminal illness that drastically reduces life expectancy, the policyholder can get an accelerated payment of up to 75 percent. Some conditions like a transplant of a major organ, heart attack, cancer, Amyotrophic Lateral Sclerosis (ALS), paralysis, or blindness, the policyholder is eligible to get a payment of up to 90% of death benefits.

To qualify for the best life insurance with living benefits payout, the policyholder needs to follow the insurance company’s guidelines and submit proof of illness. The company then assesses the documents and the situation against the guidelines. Once found accurate, payment gets released. Contact your insurance agent for more details about a living benefits rider with life insurance.

Are you Prepared for Unexpected Illnesses?

1. Cancer

Cancer is a disease where cells multiply uncontrollably and interfere with regular functions of vital organs. When detected early, most forms of cancer have a high possibility of getting cured, but when detection does not happen during the early stage of development of the disease, the chance of fatality dramatically increases.

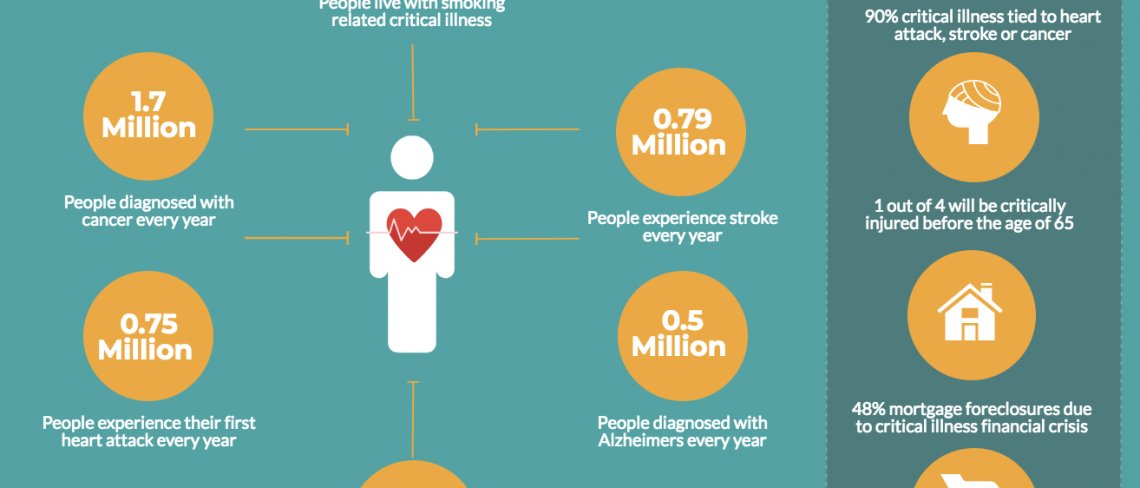

Currently, over 1.7 million cases of cancer are diagnosed yearly. Approximately 38% of people get affected by cancer at some point in their life. Though the treatment costs have been high, the number of cancer survivors is increasing steadily.

2. Heart Attack

A heart attack happens when the blood vessel that supplies blood to the heart gets completely blocked. If not detected on time and treated immediately, the condition can be fatal.

Heart attacks cause one in every four deaths in America. Over 730,000 people have a heart attack every year where 25% of people have already experienced a heart attack before.Heart attack strikes one American every 34 seconds.

3. Stroke

Brain stroke is a medical emergency where the blood supply is interrupted to a part of the brain. A brain hemorrhage can also trigger an episode. When either of this happens, brain cells rapidly die,causing death or permanent disability.

Every year, approximately 800,000 people experience a stroke. As you age, the chance of encountering a stroke significantly increases. After 55, the risk doubles every decade. Every 40 seconds, someone has a stroke.

4. Risks from Smoking

Smoking is the single most significant reason for preventable deaths in America. About half a million people lose their lives to nicotine addiction. The cost of direct medical care in the United States because of smoking-related critical illness is $170 billion per year.

Tobacco use has the potential of damaging every organ of the body. It can cause critical illness or disability. Smoking causes heart attacks, cancer, diabetes, heart diseases like Chronic Obstructive Pulmonary Disease (COPD), and lung diseases like tuberculosis. The statistics surrounding risks of smoking are staggering.

Over 17 million Americans suffer from a smoking-related disease. There are over 37 million active smokers in the country who are over 18 years of age. A study conducted in 2010 revealed that 23% of women smoked three months before they discovered they were pregnant. 11% smoked during pregnancy, and 16% smoked after delivery.

The population of smokers in HIV affected patients is twice than those who are non-smokers. 36% of people with mental disabilities have been regular smokers.

3 Reasons Why You Should Consider Living Benefits with Life Insurance

- As you age, you need to have a clear plan in place that will take care of a potential critical illness, especially the ones where you are in the high-risk bracket.

- If you think of the cost you may incur for a critical illness, the additional cost you will have to pay for living benefits will be worth it, especially if you are already considering buying a life insurance policy.

- In the event of you not using living benefits, the benefits will be paid out to your loved ones as death benefits. You won’t be losing out on payments either way.

Irrespective of your gender or age, if you are considering buying life insurance, you should strongly consider buying whole life insurance or term life insurance with living benefits included. While it is essential to make sure your family is taken care of after you are gone, it is also necessary to have peace of mind while you are living. A critical illness can catch your family unawares and throw your lifelong financial planning off-track. Don’t let that happen to you – choose living benefits. Get yourlife insurance with living benefits quotes from your insurance agent today.